Current Events

labor day weekend travel

With more people traveling over the weekend and the roads a lot busier than normal, it’s important to drive safely. Be sure you are well rested and alert, use your seat belts, observe speed limits, and follow the rules of the road.

Some more tips to keep in mind:

•Give your full attention to the road. Avoid distractions such as cell phones. (If using for directions, have connected to your Bluetooth speaker or have another passenger help navigate.

•Turn your headlights on as dusk approaches. or during inclement weather.

•Don’t let your vehicle’s gas tank get too low. If you have car trouble, pull as far as possible off the road/highway.

•Carry a disaster supplies kit in your trunk (i.e. charged cell phone, tire gauge, jumper cables, duct tape, water, blanket, nonperishable snacks).

•Let someone know where you’re going (your route and when you expect to get there).

•Use caution in work zones.

•Don’t follow vehicles too closely.

•Clean your vehicle’s lights and windows to help you see.

•Pay close attention to any bad weather.

We hope everyone has a safe and fun weekend with friends and family!

Some more tips to keep in mind:

•Give your full attention to the road. Avoid distractions such as cell phones. (If using for directions, have connected to your Bluetooth speaker or have another passenger help navigate.

•Turn your headlights on as dusk approaches. or during inclement weather.

•Don’t let your vehicle’s gas tank get too low. If you have car trouble, pull as far as possible off the road/highway.

•Carry a disaster supplies kit in your trunk (i.e. charged cell phone, tire gauge, jumper cables, duct tape, water, blanket, nonperishable snacks).

•Let someone know where you’re going (your route and when you expect to get there).

•Use caution in work zones.

•Don’t follow vehicles too closely.

•Clean your vehicle’s lights and windows to help you see.

•Pay close attention to any bad weather.

We hope everyone has a safe and fun weekend with friends and family!

Home features that can lower your insurance costs and save some money

Home Features that can lower your insurance costs💡

• Home Security System

• Newer Roofing

• Storm-Safe Windows

• Carbon monoxide detectors

• Water shutout devices

• Water shutout devices

8 Fall Home Maintenance tips

1. Check smoke detectors, fire extinguishers & first aid kits

2. Clean your chimney and fireplace

3. Wrap indoor pipes

4. Check windows

5. Inspect your roof

6. Stock up on supplies

7. Inspect your heating system

8. Finish seasonal yard maintenance

2. Clean your chimney and fireplace

3. Wrap indoor pipes

4. Check windows

5. Inspect your roof

6. Stock up on supplies

7. Inspect your heating system

8. Finish seasonal yard maintenance

HAZARD COVERAGE

STRUCTURE OF YOUR HOME

Covers the repair or rebuild of your main living structure if it’s damaged in a covered event (fire, hail, hurricane or lightning). Detached structures may also may be covered through hazard coverage.

HAZARD COVERAGE

PERSONAL BELONGINGS

Covers the cost of personal belongings

(furniture, jewelry, clothes, electronics, etc) if they are stolen or destroyed. Coverage continues even if they are stolen/damaged away from your home.

LIABILITY PROTECTION

Covers the cost of bodily injury or property damage caused by a member of your family (or a pet). Additionally, it covers the cost of medical bills caused by no-fault that can happen on your property.

LIVING EXPENSES

If you must leave your home during an extensive period of repair or rebuild, some of your living costs may also be covered.

STRUCTURE OF YOUR HOME

Covers the repair or rebuild of your main living structure if it’s damaged in a covered event (fire, hail, hurricane or lightning). Detached structures may also may be covered through hazard coverage.

HAZARD COVERAGE

PERSONAL BELONGINGS

Covers the cost of personal belongings

(furniture, jewelry, clothes, electronics, etc) if they are stolen or destroyed. Coverage continues even if they are stolen/damaged away from your home.

LIABILITY PROTECTION

Covers the cost of bodily injury or property damage caused by a member of your family (or a pet). Additionally, it covers the cost of medical bills caused by no-fault that can happen on your property.

LIVING EXPENSES

If you must leave your home during an extensive period of repair or rebuild, some of your living costs may also be covered.

Stay safe this summer

6/29/22

3. Drownings

With hot temperatures rising and it being hot most days this summer it is more common that people get outside and enjoy water activities or the pool time. If you have a pool at home or take small children to the local pool it is important to maintain active watch and play time with the children while in attendance. If you are going to enjoy the pool at home it is important to have a gate or locked fence around the pool so children aren't able to sneak or fall in without supervision. About 10 people per day die in the U.S. from non-boating related drownings. Amongst those drownings, the age ranges are 14 and younger.

All children should be properly supervised by adults with all water activities and using a life jacket if unable to swim on their own.

4. Home burglaries and assaults

A lot of times throughout the summer, families take the time to go on vacations and enjoy time away from the home. Home burglaries and assaults are always higher in the summer. Unoccupied home burglaries are covered by the homeowners insurance, but the risk can be reduced by having proper security systems in place along with motion detector lights and having neighbors be in charge of mail duty, packages and other important things that might arrive at your house while you are away.

All of these insurance claims that are more common during the summer can be overwhelming and make you want to stay home or inside, but with the staying prepared and having all these security items in place when you leave you can enjoy a summer without any major worries.

5. Boating Accidents

Recreational boating accidents, operator not paying attention, operator inexperience with driving a boat, improper lookout, and machinery failure or excessive speed are all the top reasons why boating accidents occur.

It is important to take proper safety classes, insuring your boat is in good working order as well as everyone on board keeping lookout and wearing life jackets. Most boat drownings are because the victims fail to wear life jackets.

Many recreational boating accidents cause high dollar amounts in property damage.

With hot temperatures rising and it being hot most days this summer it is more common that people get outside and enjoy water activities or the pool time. If you have a pool at home or take small children to the local pool it is important to maintain active watch and play time with the children while in attendance. If you are going to enjoy the pool at home it is important to have a gate or locked fence around the pool so children aren't able to sneak or fall in without supervision. About 10 people per day die in the U.S. from non-boating related drownings. Amongst those drownings, the age ranges are 14 and younger.

All children should be properly supervised by adults with all water activities and using a life jacket if unable to swim on their own.

4. Home burglaries and assaults

A lot of times throughout the summer, families take the time to go on vacations and enjoy time away from the home. Home burglaries and assaults are always higher in the summer. Unoccupied home burglaries are covered by the homeowners insurance, but the risk can be reduced by having proper security systems in place along with motion detector lights and having neighbors be in charge of mail duty, packages and other important things that might arrive at your house while you are away.

All of these insurance claims that are more common during the summer can be overwhelming and make you want to stay home or inside, but with the staying prepared and having all these security items in place when you leave you can enjoy a summer without any major worries.

5. Boating Accidents

Recreational boating accidents, operator not paying attention, operator inexperience with driving a boat, improper lookout, and machinery failure or excessive speed are all the top reasons why boating accidents occur.

It is important to take proper safety classes, insuring your boat is in good working order as well as everyone on board keeping lookout and wearing life jackets. Most boat drownings are because the victims fail to wear life jackets.

Many recreational boating accidents cause high dollar amounts in property damage.

Homeowners insurance info for

beginners

Homeowners break down for beginners:

Homeowners insurance is a necessity. And not just because it shields as a safe guard to your home and possessions against theft or damage. Almost every mortgage company require borrowers to have insurance coverage for the full or fair value of a property (usually the purchase price) and won't make a loan or finance a residential real estate transaction without proof of it.

Some may not know that you don't even have to own your home to need insurance; many and in fact most, landlords request or require their tenants to maintain renters insurance during the extent of the lease. Below are some basic homeowners insurance policy plugs to keep in mind:

Hope this was helpful. If you have any questions in regards to your policies or coverage, reach out to us today on our websites contact page www.humboldtmutualinsurance.com or call our office at 515-332-2953!

Homeowners insurance is a necessity. And not just because it shields as a safe guard to your home and possessions against theft or damage. Almost every mortgage company require borrowers to have insurance coverage for the full or fair value of a property (usually the purchase price) and won't make a loan or finance a residential real estate transaction without proof of it.

Some may not know that you don't even have to own your home to need insurance; many and in fact most, landlords request or require their tenants to maintain renters insurance during the extent of the lease. Below are some basic homeowners insurance policy plugs to keep in mind:

- Homeowners insurance policies generally cover destruction and damage to a residence's interior and exterior, the loss or theft of possessions, and personal liability for harm to others.

- Three basic levels of coverage exist: replacement cost, actual cash value, and extended replacement cost/value.

- Policy rates are, to a great extent, determined by the insurer's risk that you'll file a claim; they assess this risk based on past claim history associated with the home, the neighborhood, and the home's condition.

Hope this was helpful. If you have any questions in regards to your policies or coverage, reach out to us today on our websites contact page www.humboldtmutualinsurance.com or call our office at 515-332-2953!

With more people traveling over the weekend and the roads a lot busier than normal, it’s important to drive safely. Be sure you are well rested and alert, use your seat belts, observe speed limits, and follow the rules of the road.

Some more tips to keep in mind:

•Give your full attention to the road. Avoid distractions such as cell phones. (If using for directions, have connected to your Bluetooth speaker or have another passenger help navigate.

•Turn your headlights on as dusk approaches. or during inclement weather.

•Don’t let your vehicle’s gas tank get too low. If you have car trouble, pull as far as possible off the road/highway.

•Carry a disaster supplies kit in your trunk (i.e. charged cell phone, tire gauge, jumper cables, duct tape, water, blanket, nonperishable snacks).

•Let someone know where you’re going (your route and when you expect to get there).

•Use caution in work zones.

•Don’t follow vehicles too closely.

•Clean your vehicle’s lights and windows to help you see.

•Pay close attention to any bad weather.

We hope everyone has a safe and fun weekend with friends and family!

Some more tips to keep in mind:

•Give your full attention to the road. Avoid distractions such as cell phones. (If using for directions, have connected to your Bluetooth speaker or have another passenger help navigate.

•Turn your headlights on as dusk approaches. or during inclement weather.

•Don’t let your vehicle’s gas tank get too low. If you have car trouble, pull as far as possible off the road/highway.

•Carry a disaster supplies kit in your trunk (i.e. charged cell phone, tire gauge, jumper cables, duct tape, water, blanket, nonperishable snacks).

•Let someone know where you’re going (your route and when you expect to get there).

•Use caution in work zones.

•Don’t follow vehicles too closely.

•Clean your vehicle’s lights and windows to help you see.

•Pay close attention to any bad weather.

We hope everyone has a safe and fun weekend with friends and family!

Barn fire safety checklist

Animals, People and Property are at risk when a fire occurs. Be sure to examine your barn and outbuildings for any fire hazards that could lead to tragic loss.

We know there are many more than tips to remember in addition to this list, so if you have an important one you’d like to share, comment on our Facebook page or Instagram Page!

Here are some suggestions:

- All wiring is free from damage

- Barn is a smoke-free zone

- Dust and cobwebs removed from any areas with electrical outlets and lights

- Oil rags stored in a closed, metal container or cabinet away from heat.

- Exits clearly marked and pathways always clear

- Everyone that works within the barn knows proper safety and knows personal safety is first priority if a fire occurs

- Straw, hay, feed and flammable items are to be stored away from the barn

- Electrical equipment properly labeled for agricultural or commercial use

- Hazard checks take place on a set schedule

As we mentioned, there are a lot more checks to ensure we keep ourselves, our animals and our property safe - we’d love to hear your additions over on our Facebook page or Instagram page!

We know there are many more than tips to remember in addition to this list, so if you have an important one you’d like to share, comment on our Facebook page or Instagram Page!

Here are some suggestions:

- All wiring is free from damage

- Barn is a smoke-free zone

- Dust and cobwebs removed from any areas with electrical outlets and lights

- Oil rags stored in a closed, metal container or cabinet away from heat.

- Exits clearly marked and pathways always clear

- Everyone that works within the barn knows proper safety and knows personal safety is first priority if a fire occurs

- Straw, hay, feed and flammable items are to be stored away from the barn

- Electrical equipment properly labeled for agricultural or commercial use

- Hazard checks take place on a set schedule

As we mentioned, there are a lot more checks to ensure we keep ourselves, our animals and our property safe - we’d love to hear your additions over on our Facebook page or Instagram page!

are you covered?

Although insurance may not be at the top of your priority list every day, it will be something you think of at time of an accident or disaster.

Here are a few tips to take into account to make sure you are covered:

1. If it has been a while since you reviewed your coverage, sit down with your insurance agent and discuss your policies. It can be intimidating reviewing coverage on your own, ask your agent any questions you don’t understand while going over coverage, exclusions and it’s a good time to review assets as well.

2. If you own something, it has value, insure it. You always want to make sure your valuables are covered in the event of a loss. Insurance companies use the law of large numbers in determining rates. As such it is wise to insure anything of significant value given the relative cost of insuring it.

3. Don’t cut corners. The worst time to realize you don’t have enough coverage or the right coverage is in the event of a loss. Although a monthly payment can seem irritating, it’s best in the long run not to just strive for ther lowest payment possible. This can get you into some trouble when that loss occurs and you aren’t covered properly.

In any event of loss, Humboldt Mutual Insurance Association is Looking out For Your Tomorrow! Call us today to make you are properly covered and review your policies!

You can reach us at 515-332-2953 or here on our website.

Here are a few tips to take into account to make sure you are covered:

1. If it has been a while since you reviewed your coverage, sit down with your insurance agent and discuss your policies. It can be intimidating reviewing coverage on your own, ask your agent any questions you don’t understand while going over coverage, exclusions and it’s a good time to review assets as well.

2. If you own something, it has value, insure it. You always want to make sure your valuables are covered in the event of a loss. Insurance companies use the law of large numbers in determining rates. As such it is wise to insure anything of significant value given the relative cost of insuring it.

3. Don’t cut corners. The worst time to realize you don’t have enough coverage or the right coverage is in the event of a loss. Although a monthly payment can seem irritating, it’s best in the long run not to just strive for ther lowest payment possible. This can get you into some trouble when that loss occurs and you aren’t covered properly.

In any event of loss, Humboldt Mutual Insurance Association is Looking out For Your Tomorrow! Call us today to make you are properly covered and review your policies!

You can reach us at 515-332-2953 or here on our website.

bbq season

With summer season on the horizon and the ramping up of our grill usage for BBQ season - we have some tips to keep you safe when doing so.

- Make sure that your grill is cleaned regularly to prevent fires, especially after each grill outing.

- Keep the grill pushed away from the house and other flammable items.

- Make sure that the area around the grill is free of tripping hazards.

- Make sure the grill is on a flat, hard and level surface.

- Wear proper clothing that won’t interfere with the cooking process, making sure all aprons are tied tightly to your body.

- Never leave the grill unattended. (Keeping all small children away from the grill and in parent supervision while grill is in use.)

- Always keep a fire extinguisher near by Incase of emergencies.

Should a fire occur, your homeowner’s insurance policy may help you recover. Ask your agent about your homeowner’s insurance policy coverages or visit our website to contact us today!

Contact us at 515-332-2953 or here on our website.

- Make sure that your grill is cleaned regularly to prevent fires, especially after each grill outing.

- Keep the grill pushed away from the house and other flammable items.

- Make sure that the area around the grill is free of tripping hazards.

- Make sure the grill is on a flat, hard and level surface.

- Wear proper clothing that won’t interfere with the cooking process, making sure all aprons are tied tightly to your body.

- Never leave the grill unattended. (Keeping all small children away from the grill and in parent supervision while grill is in use.)

- Always keep a fire extinguisher near by Incase of emergencies.

Should a fire occur, your homeowner’s insurance policy may help you recover. Ask your agent about your homeowner’s insurance policy coverages or visit our website to contact us today!

Contact us at 515-332-2953 or here on our website.

spring cleaning

With Spring weather on the horizon (hopefully) we know the cold winter months leave behind some potential hazards or damage to your house.

We have a few checklist Items outside your home that should be inspected and checked to ensure everything is in good condition:

Roof: Be sure and check for any damage from snow or ice. Any repairs that can be made will reduce the possibility of leaks. If you have any skylight windows, check outside for a buildup of leaves and other debris left behind from any storms. Also, it is important to go around the inside of the house and inspect the ceiling for any signs of leaks. Last, but not least, when you are on the roof - make sure you are using the proper safety precautions and safety gear. If you don't feel comfortable, no doubt, leave it to the professionals. Schedule those appointments today for spring cleaning.

Trees: First need to visually inspect trees for damage and/or rot. If you see that you have some trees that may cause issue and are experienced to remove all trees that may cause issues during heavy winds or a storm, proceed to do so. If you're not comfortable, of course, consider hiring a licensed professional. Make sure that all other trees, bushes, shrubs are trimmed and away from any utility wires.

Gutters: Inspect every Inch of the gutter for leaves and other debris. All downspouts must be clear to keep water flowing and reduce the possibility of any water damage to the house/basement.

Driveways and sidewalks: Repair any major cracks, broken or uneven surfaces and steps leading into the home that create a much safer level ground for walking.

These maintenance tips can go a long way in reducing hazards (AND CLAIMS) by keeping your home safe throughout the year.

Of course in any emergency, Humboldt Mutual is looking out for your tomorrow! If you have just endured severe weather, and your in need of submitting a claim, don't hesitate!

Humboldt Mutual will help make your experience, easy and convenient.

To submit your claim, click here below or call our office, 515-332-2953. (A representative will be with you shortly)

If you need to speak to someone direct, our adjuster Heather Wilson is available and her phone number is 515-890-3277 or also available, Bob Abens, which you can reach at 515-890-3307. Or if you prefer to mail your claim information, please send it to: P.O Box 35 Humboldt, IA 50548.

Please take whatever measures to protect your property! Take Action Right Away!

We have a few checklist Items outside your home that should be inspected and checked to ensure everything is in good condition:

Roof: Be sure and check for any damage from snow or ice. Any repairs that can be made will reduce the possibility of leaks. If you have any skylight windows, check outside for a buildup of leaves and other debris left behind from any storms. Also, it is important to go around the inside of the house and inspect the ceiling for any signs of leaks. Last, but not least, when you are on the roof - make sure you are using the proper safety precautions and safety gear. If you don't feel comfortable, no doubt, leave it to the professionals. Schedule those appointments today for spring cleaning.

Trees: First need to visually inspect trees for damage and/or rot. If you see that you have some trees that may cause issue and are experienced to remove all trees that may cause issues during heavy winds or a storm, proceed to do so. If you're not comfortable, of course, consider hiring a licensed professional. Make sure that all other trees, bushes, shrubs are trimmed and away from any utility wires.

Gutters: Inspect every Inch of the gutter for leaves and other debris. All downspouts must be clear to keep water flowing and reduce the possibility of any water damage to the house/basement.

Driveways and sidewalks: Repair any major cracks, broken or uneven surfaces and steps leading into the home that create a much safer level ground for walking.

These maintenance tips can go a long way in reducing hazards (AND CLAIMS) by keeping your home safe throughout the year.

Of course in any emergency, Humboldt Mutual is looking out for your tomorrow! If you have just endured severe weather, and your in need of submitting a claim, don't hesitate!

Humboldt Mutual will help make your experience, easy and convenient.

To submit your claim, click here below or call our office, 515-332-2953. (A representative will be with you shortly)

If you need to speak to someone direct, our adjuster Heather Wilson is available and her phone number is 515-890-3277 or also available, Bob Abens, which you can reach at 515-890-3307. Or if you prefer to mail your claim information, please send it to: P.O Box 35 Humboldt, IA 50548.

Please take whatever measures to protect your property! Take Action Right Away!

What is valuation?

What’s in a Valuation?

Property valuation for insurance purposes and how these valuations are used with different types of policies are often misunderstood. We have all heard the terms Replacement Cost, Actual Cash Value (ACV,) but what do they mean, how are each determined and when are each used?

Replacement Cost is determined using a guide that takes in to account the specific features of each house or building and the quality of construction materials used to determine a cost estimate to rebuild the structure. This figure is known as the replacement cost value of the house.

Actual Cash Value is determined by calculating the replacement cost and deducting for depreciation. If there have been improvements made to the home or building, such as a $30,000 kitchen remodel, the improvements are then added back in to the depreciated figure to determine the Actual Cash Value. The amount of depreciation taken will vary having less taken on newer updated items and larger depreciation amounts taken on older items in poorer condition.

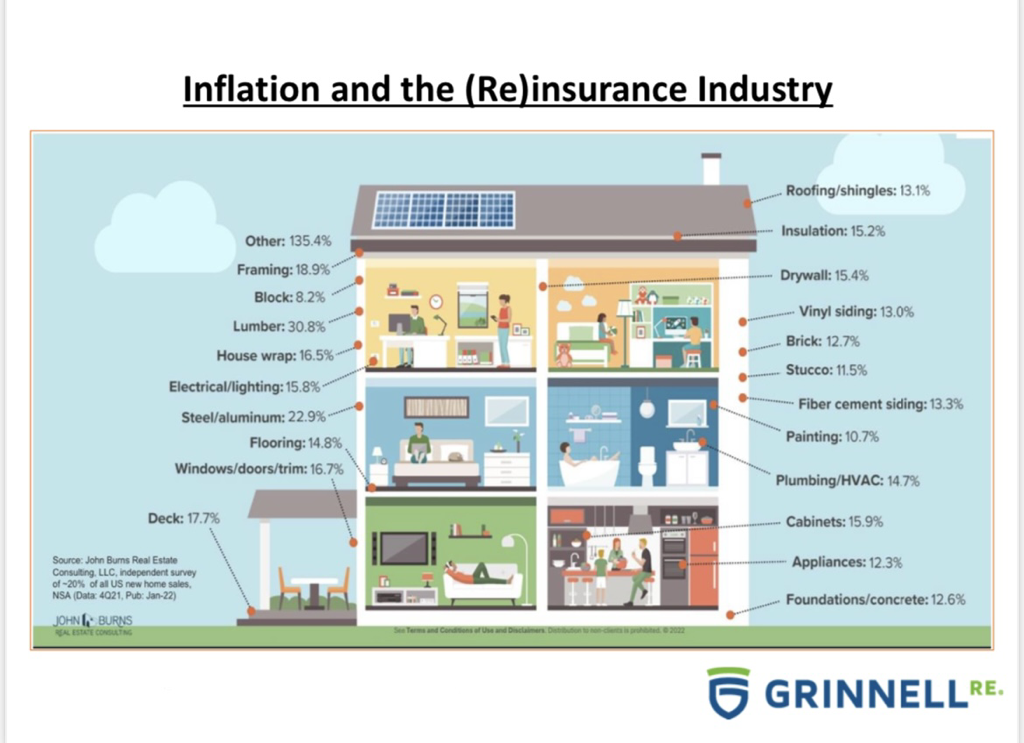

Insurance policies use Replacement Cost and Actual Cash Value to determine coverage limits. The valuation used depends largely on the basis of loss settlement within the policy. An Insured who purchases a policy with loss settlement based on replacement must insure the property covered at a limit consistent with the replacement cost valuation. Actual Cash Value can be used when depreciation will be taken at loss. Construction costs have increased dramatically over the past 12-15 months and it is very important to keep insured values current based on the loss valuation used in each individual policy. Attached is a slide showing the average increase in building costs since the beginning of 2021. The percentages shown are national averages and can be much higher locally. Please visit with your agent and review your coverage to be sure limits are adequate

Property valuation for insurance purposes and how these valuations are used with different types of policies are often misunderstood. We have all heard the terms Replacement Cost, Actual Cash Value (ACV,) but what do they mean, how are each determined and when are each used?

Replacement Cost is determined using a guide that takes in to account the specific features of each house or building and the quality of construction materials used to determine a cost estimate to rebuild the structure. This figure is known as the replacement cost value of the house.

Actual Cash Value is determined by calculating the replacement cost and deducting for depreciation. If there have been improvements made to the home or building, such as a $30,000 kitchen remodel, the improvements are then added back in to the depreciated figure to determine the Actual Cash Value. The amount of depreciation taken will vary having less taken on newer updated items and larger depreciation amounts taken on older items in poorer condition.

Insurance policies use Replacement Cost and Actual Cash Value to determine coverage limits. The valuation used depends largely on the basis of loss settlement within the policy. An Insured who purchases a policy with loss settlement based on replacement must insure the property covered at a limit consistent with the replacement cost valuation. Actual Cash Value can be used when depreciation will be taken at loss. Construction costs have increased dramatically over the past 12-15 months and it is very important to keep insured values current based on the loss valuation used in each individual policy. Attached is a slide showing the average increase in building costs since the beginning of 2021. The percentages shown are national averages and can be much higher locally. Please visit with your agent and review your coverage to be sure limits are adequate

sponsoring county fair queen contests

Humboldt Mutual will be going on year 7 for sponsoring affiliated agencies County Fair Queen Contests. We take pride in sponsoring these events and getting the opportunity to help these young women and men start the next chapter in life. This summer we will be sponsoring a total of 8 county Fair Queen Contests. Those counties being Humboldt, Greene, Kossuth, Wright, Webster, Hamilton, Franklin and Pocahontas. Each year we have continued to add more and more of our affiliated Agency's counties to that list. We are super excited at the growth that this sponsored event has received over the past few years. We hope to continue that growth moving forward. If you have a county that we are not currently sponsoring in and you think we would be an asset to the Fair Board in aiding these kids in preparation for college - please reach out to [email protected].

If you are located in Humboldt County and are interested in a shot at becoming the next 2022 Humboldt County Fair Queen - Be sure to keep your eyes out for the application form this spring!

If you are located in Humboldt County and are interested in a shot at becoming the next 2022 Humboldt County Fair Queen - Be sure to keep your eyes out for the application form this spring!

attention agents!

Agents -

All 2021 Rate Adjustment/Changes will be located under the Resources Tab in the secure location. If you don't have the password - please contact [email protected]. If you have any questions about any of the changes - please contact our office @ 515-332-2953.

All 2021 Rate Adjustment/Changes will be located under the Resources Tab in the secure location. If you don't have the password - please contact [email protected]. If you have any questions about any of the changes - please contact our office @ 515-332-2953.